RIO DE JANEIRO, BRAZIL – With the first stage of the Open Banking implementation scheduled for February 1st, a process promoting the right of customers to share their own financial information will be initiated in banks.

This will bring about a crucial change in how banks structure their business and interact with their customers, once customers are recognized as the effective “owners” of their information. This transition will not only change the relationship customers have with financial institutions, but also the dynamics and essence of business models in the banking sector, and may redefine the country’s whole financial services ecosystem.

Banks will have the opportunity to look at Open Banking from the customer’s perspective in order to identify their unmet needs and to consider how Open Banking can be used to meet them, producing positive changes for both banks and consumers.

A number of issues still permeate the subject and we need to reflect on them, such as: What changes for individuals? What are the expectations from the customer’s perspective? Will individual consumers be able to download a single app on their mobile devices, in which they can access services and options from different banks? What will be the added value for corporate customers? These and other questions have been explored by the market, and some will be addressed below.

Once Open Banking is fully operational, customers’ consent is enough for their data to be shared among financial institutions following the reciprocity principle. The best customers’ profile, currently blocked by banks, can be accessed by the competition upon customers’ consent. Their practices, if they often have money available for investments, if they pay their bills on time, among other data, can help create an expanded and personalized perspective of each client by financial institutions.

Open Banking comes to promote even greater transparency and offer consumers a better management of their financial resources, helping them to obtain the best financial products and service offers in a faster, safer and entirely digital format.

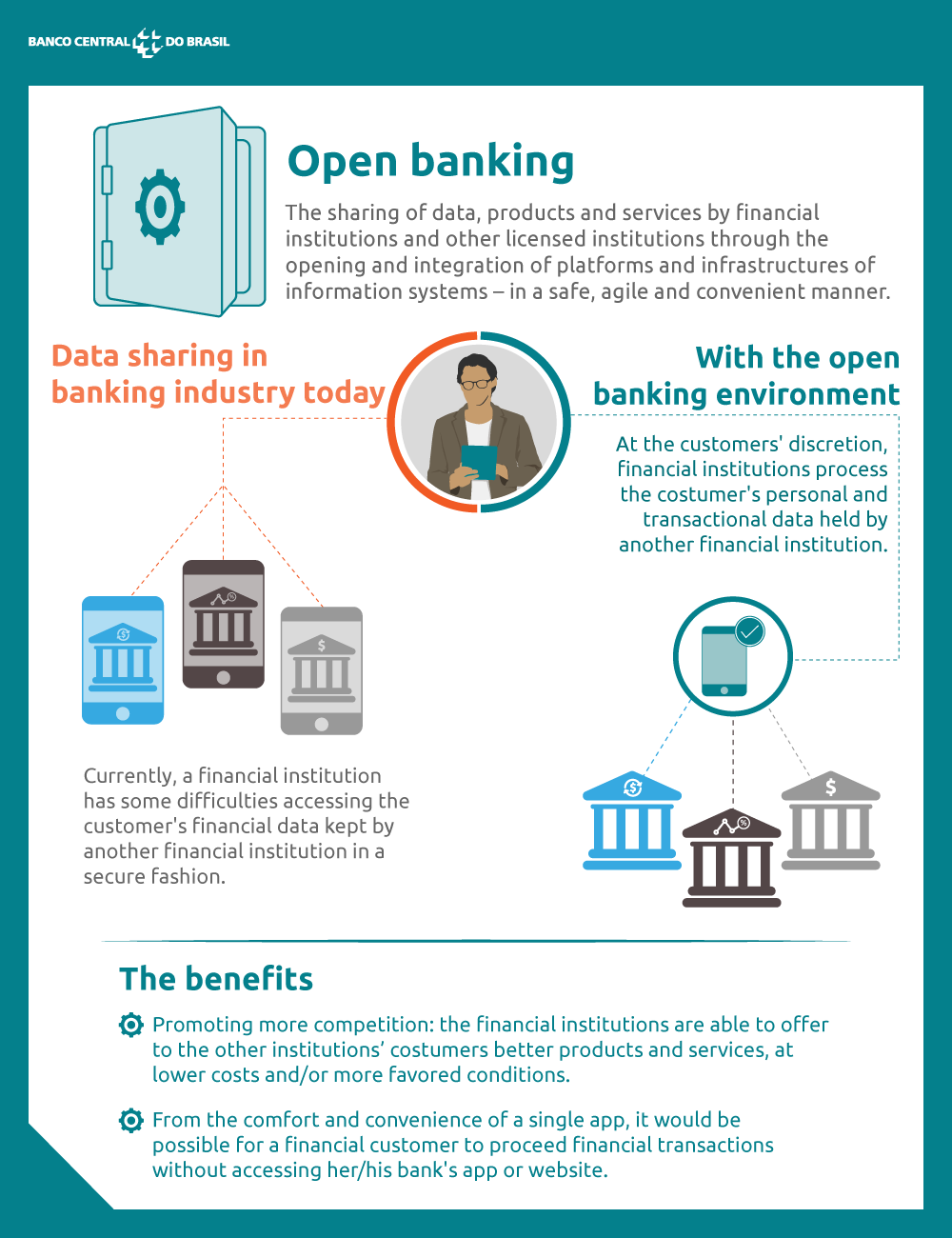

Nowadays, most banks’ products are accessed and managed through their own channels and, although customers have products from several institutions, organizations have limited visibility among them. Moreover, customers find it difficult to consolidate and manage their financial life when using more than one institution. With the advent of Open Banking, new services and products will be simultaneously combined, creating a complex network of providers that will need to interact with each other, not only to enable data exchange, but also to address the increasingly demanding customers’ needs.

Consultancy firm Deloitte identified in its FEBRABAN Banking Technology 2020 Survey that the financial industry is already preparing for the coming of Open Banking. Faced with a scenario in which digital channels were responsible for 63% of transactions in 2019, and investments in technology in the same year reached R$24.6 (US$4.55) billion – the development of external APIs (Application Programming Interfaces), i.e., APIs that are open to the market, are moving at a very fast rate.

APIs will technically enable the exchange of information between institutions and will provide customers with the possibility of consolidating their accounts, investments and products, both from the bank itself and from other institutions. New account aggregation functionalities will enable customers to access, in the financial institution’s app, all accounts, investments, services and products they have contracted, both from the bank itself and from other institutions.

The technological infrastructure, the data sharing models and the regulatory guidelines themselves are enablers of Open Banking, where new business models facilitated by these features will lead to sensitive changes in market dynamics. There is no doubt that the financial services industry is moving towards a more open and distributed scenario, and the creation of new ecosystems with strategic partners to deliver new services and solutions to end customers will be a key factor in competitiveness.

Open Banking stresses the need for financial institutions to expand their ecosystem models, even with potential competitors, bigtechs, fintechs and companies from other sectors in order to sustain their competitiveness and leverage new revenue sources. Banks should now strategically target partnerships to sustain business seeking a prominent position in the market.

The disruption caused by Open Banking should further encourage the entrance of new non-traditional players – even from other market segments – which will increase competition in the sector and pressure on prices. Another competitive aspect, relevant in this process, will be financial institutions’ ability to analyze shared data and create measures that add value to their customers’ experience and journey.

While a financial institution shares its data, it also has the opportunity to add additional information, creating an expanded perspective of customers, that is, beyond the universe it currently controls. From this bundled universe of information and using the data for relationship initiatives, such as retention and prospecting, banks can deploy several ‘value levers’ through Open Banking.

Independently of their size, financial institutions must foster and actively engage in the disruptive moment we find ourselves in. By embracing this position, these organizations place themselves at the forefront, leading the transformation process in the sector.

Source: Sérgio Biagini, in Infomoney