RIO DE JANEIRO, BRAZIL – In eight years, the collection of churches in Brazil has virtually doubled. The increase is a result of the growth of religious bodies in the country and increased donations, tithes, and offerings to temples.

The income of churches rose from R$13.3 billion in 2006 to R$24.2 (US$6) billion in 2013, according to data from the Federal Treasury, obtained by the Law on Access to Information.

Correcting the 2013 figure for inflation, it would represent close to R$32 billion in current terms. Nearly half of what the government expects to spend in 2019 on BPC, an assistance benefit paid to impoverished elderly people and the disabled.

This represents revenue of nearly R$88 million per day for religious bodies, in updated amounts.

In an interview with the newspaper Folha de S.Paulo in April, the Secretary of Treasury, Marcos Cintra, said that even the faithful would pay taxes on tithing through the tax reform proposal that is discussing a tax on financial transactions — along the lines of the former CPMF — Provisional Contribution on Financial Transactions.

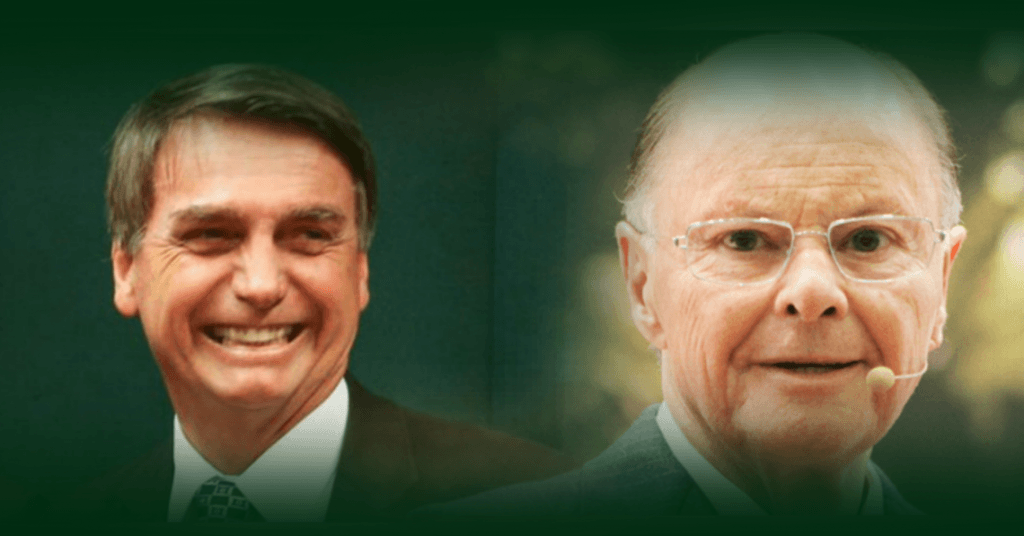

President Jair Bolsonaro’s electoral base, religious bodies have reacted and the government has set up an operation to prevent this. The Federal Treasury is unable to estimate how much it fails to collect due to the churches’ tax exemption.

“They are immune. So, the tax does not even reach us. If I don’t even know how this revenue would be taxed, there is no way to know what is no longer collected,” said Marcelo Gomide, the coordinator of the tax authorities’ forecast and analysis. But he said that the exemption was at least R$674 million last year in terms of social security.

These temples are not required to pay the employer’s share of salaries for Social Security, but there is a payroll discount for the INSS (National Institute of Social Security) in cases of formal workers, such as secretaries.

Treasury data also point to a significant increase in the number of churches in Brazil, from 10,000 in 2006 to 18,500 in 2013. In 2018, the number rose to 25,000.

No data are available yet for the most recent collections. This, however, is the number of religious bodies with CNPJ — National Register of Legal Entities — an obligation for all temples. But a large proportion of churches are unregulated, thus untraceable by the tax authorities.

When registered in the Treasury, the body is required to provide a document detailing the progress of its assets in the year and specifying the origin of such funds.

The balance, obtained by the publication, shows that the increase in temples’ revenue came mainly from donations and other sources, such as rents.

In 2014, churches were relieved of their obligation to provide this information to the Treasury due to the change in the accountability framework. A year later, this requirement was taken up again, but the data is still being compiled.

The Treasury admits that a significant part of the donations and tithes are performed by payments in cash, which hinders control and inspection.

“Every statement is a piece of information provided. It is information that the Treasury will receive, and that reflects what the taxpayer said. But, on the whole, there is an evolution, an increase in revenue collection,” said Gomide.

Just before the government submits its tax reform proposal, the evangelical benches of Congress have met with Bolsonaro and members of the economic team seeking to uphold the exemptions currently granted to their temples.

“We are urging the continuity of this immunity, which is enshrined in the Constitution. And by our representation in the Chamber, this [taxation of churches] would not pass [in a plenary vote],” said the leader of the bench, Deputy Silas Câmara (PRB-AM). The evangelical caucus is made up of almost 200 deputies and senators.

As a result, the government has already relaxed this year’s rules of accountability to churches. In one of the measures, religious bodies’ establishments that do not enjoy administrative independence or are not budget managers are exempted from having a CNPJ.

On Wednesday, August 7th, evangelical leaders had lunch with Bolsonaro and asked for an end to the enforcement of fines on churches by the Federal Treasury. Legislators claim that churches in the remote corners of the country can not meet the requirements or even have a CNPJ.

“The reform is based on tax simplification. Whoever wants to simplify this in Brazil will not want to jeopardize or create red tape to undermine the evangelical temples,” said the Chamber.