RIO DE JANEIRO, BRAZIL – Last Thursday , August 6th, the Argentine e-commerce company Mercado Libre overtook the Brazilian mining company Vale (VALE3) and became the most valuable in Latin America.

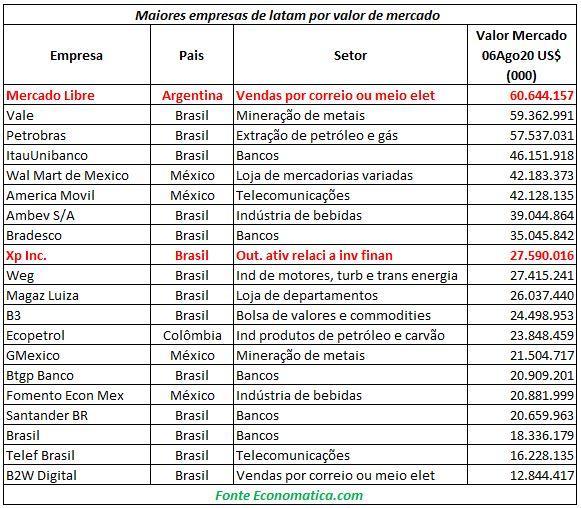

At the end of the last trading session, Mercado Libre was valued at US$60.6 billion, against US$59.3 billion for Vale, according to data from Economatica consultancy. In third position came Petrobras (PETR3; PETR4), worth US$57.5 billion.

The Argentine company, which was listed on the US NASDAQ exchange, was one of the big winners in Q2, with its shares appreciating 101.8 percent between April and June. This leaves it behind only Tesla, which jumped 106.1 percent, among the 100 companies in the technology index.

Also in Brazil, where companies like Magazine Luiza (MGLU3), B2W (BTOW3) and Via Varejo (VVAR3) have posted positive performances due to consumption in the pandemic, Mercado Libre should also be the big “winner”.

This was Bradesco BBI’s assessment in late July, when it raised its recommendation for the company to the purchase equivalent. “We expect that Mercado Libre will have a much stronger quarter in Brazil than expected at the start of the Covid-19 crisis in March,” said the analysts.

According to them, the Argentine company is expected to add more online sales growth (GMV), at approximately R$4 billion (US$3.5 billion), compared to local peers, projected to increase from R$3 billion to R$3.5 billion.

The company’s results will be released on Monday, August 10th, (10) and the next day, Stelleo Tolda, Mercado Libre’s director of operations, and Tulio Oliveira, vice-president of Mercado Pago, will participate in a live broadcast for InfoMoney, as part of the ‘Por dentro dos resultados’ series. They will comment on the year’s results and answer viewer’s questions.

The most valuable in Latin America

According to a survey conducted by Economatica, of the 20 most valuable companies in Latin America, 14 are Brazilian. Mexico had four representatives, while Colombia and Argentina had only one each.

The financial sector was the main highlight, with seven companies, all from Brazil: the banks Itaú (ITUB4), Bradesco (BBDC3; BBDC4), BTG (BPAC11), Santander Brasil (SANB11) and Banco do Brasil (BBAS3), in addition to B3 (B3SA3) and also XP Inc., which also went public in the United States and is ranked ninth, valued at US$27.59 billion.

From Mexico, the companies on the list were Wal-Mart Mexico, América Móvil, Grupo México and Fomento Economico Mexicano SAB, while the Colombian representative was Ecopetrol oil company.